Controlled Money / Investment Accounts

Modified on Thu, 23 Oct, 2025 at 1:38 AM

Overview

Controlled Money (CMA) or Investment accounts are managed via a matter. Before Investment or CMA transactions can be posted to a matter, an investment/CMA account must be created.

Interest earned or charges are processed directly to the CMA/investment account.

The difference between a CMA and Investment account depends on your jurisdiction. Check with your local Law Society if you are unsure which type of account you need to create.

TABLE OF CONTENTS

- Overview

- How to create a new investment / CMA on a matter

- Recording Investment / CMA transactions

- How to reverse an investment / CMA transaction

How to create a new investment / CMA on a matter

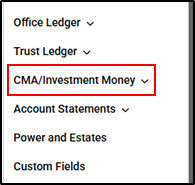

New investment/CMA are created within the Controlled Money selection on the matter, as follows:

1. Navigate to the relevant Matter.

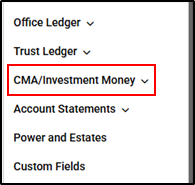

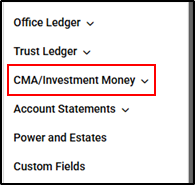

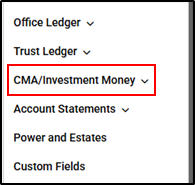

2. Select the CMA/Investment Money drop down.

3. Select Create Account.

4. Define if the account is Controlled Money or an Investment account.

5. Select the Currency.

6. Enter the Display Name for the account, this is how it will appear on the Controlled Money/ Investment ledger.

7. Enter the Financial Institution.

8. Enter the Branch Code (BSB).

9. Enter the Routing Code (if applicable).

10. Enter the Account Name and Account Number.

11. The following fields are not mandatory to complete the setup of a new controlled money or investment account:

- Date Opened: Date the account was opened.

- Matures On: Date the investment is due to mature.

- Duration: The duration the account is intended to be opened.

- Duration Unit: Enter the unit as a number, then define the unit e.g. days, weeks, months or years.

- Interest Payable From: The date the interest applies from.

- Interest Period: On Maturity, Monthly or Yearly

- Interest Rate: Interest rate percentage.

- Expiry Action: The intended action at the end of the investment period.

- Tax File Number: Enter the Tax File Number. (AU only)

- Beneficiaries: Enter any beneficiary names, if applicable.

- Description: Internal Memo.

12. Once the relevant information has been completed, Select Save.

Recording Investment / CMA transactions

1. Navigate to the relevant Matter.

2. Select the CMA/Investment drop down in the Matter Actions Menu.

3. Select the account from the drop-down list and select New Transaction.

4. From the What type of transaction do you want to post? list, select the relevant transaction type.

- Receipt: Receipt refers to a third party deposit into the controlled money or investment account.

- Receipt from General Trust: When the funds have been deposited into the controlled money or investment account from the firm trust account. Receipt from general trust will create a ledger entry on both the controlled money or investment account and on the trust ledger on the matter.

- Payment: Payment refers to a withdrawal from the controlled money or investment account to a third party.

- Payment to General Trust: When the funds are being withdrawn from the controlled money or investment account into the firm trust account. Payment to general trust will create a ledger entry on both the controlled money or investment account and on the trust ledger on the matter.

When a receipt option is selected, the Receipt Details screen will appear, complete as follows:

I. Select the date the transaction is being entered.

II. Enter the original date; the date the funds were deposited into the account.

III. Start typing a name in the Received From field to select an entity from the directory. If the entity does not exist, a purple New symbol will appear to the right of the field.

IV. Enter the Amount received.

V. Select the Receipt Method in which the funds were received.

VI. Enter a Reference (if known).

VII. Enter a Description/Reason.

VIII. click on Save at the bottom of the screen.

When a Payment options is selected, the Payment Details screen will appear, complete as follows:

I. Select the date the transaction is being entered.

II. Enter the payment Amount.

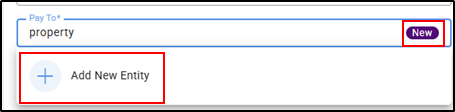

III. Start typing a name in the Pay To field to select an entity from the directory. If the entity does not exist, a purple New symbol will appear to the right of the field.

Note: When adding a new supplier during the processing of a transaction, additional address and payment details will need to be entered on the entity card and the newly created Supplier will be taken through a Supplier Verification process. This process allows Supplier banking information to be reviewed prior to any Payment being made to the supplier. Please see EvolveGo - Supplier Verification for a detailed explanation on the Supplier verification process and steps on how perform a Supplier verification

IV. Select the authorising employee.

V. Select the payment method.

VI. If known, enter a Reference for the payment.

VII. Enter a Reason/Description for the payment being made.

VII. Select Save in the bottom right of the screen.

5. Once a transaction has been posted, to view the account ledger select the Controlled Money drop down from the matter card.

6. Choose the relevant controlled money or investment account, select View Transactions.

7. The account ledger will be displayed.

Reversing an Investment / CMA transaction

1. Navigate to the relevant Matter.

2. Select the CMA/Investment drop down.

3. Click on the account from the list and choose View Transactions.

4. The account ledger will display. Hover over the transaction line to be reversed. Select the ellipses at the end of the line.

5. Select Reverse from the drop down.

6. In the Reverse CMA Transaction screen, enter the reason for the reversal and ensure the reversal date is correct.

7. Select Reverse.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article